In Spain, the price of housing continues to rise. This is the unequivocal headline that we can extract after analyzing the data of the first term of this year which was made public by the Instituto Nacional de Estadística (INE). These facts and figures show a price increase of 8,5% which represents the highest rise in the last 15 years. If we compare this data with the end of 2021, we can see that we have exceeded the prices. In addition, during this first term of the year, transactions as well as registration of mortgages constituted on housing did not stop growing. Some weeks ago, we wrote an article in this blog giving an X-ray on second-hand housing prices in Spain. In that article we stated that, in February, a sixteenth consecutive interannual increase on second-hand housing in Spain had taken place, revealing a great interest on the part of real estate buyers. We must also add new construction housing, although this is an increasingly scarce commodity in our country, especially in large cities where it is difficult to find. The facts and figures shown by INE confirm this interest in the purchase of property. However, this growing demand linked to the increased cost of materials, due to the war in Ukraine, has caused prices to soar. So much so that we have to go back to the year 2007, in the midst of the real estate bubble, in order to find a similar price increase. If we put ourselves in the years prior to the pandemic we can see that the maximum growth that was reached was 7,2%, less than one point in relation to 2022. In all, five consecutive terms have passed where flats in our country have continued to become more and more expensive.

SUBSTANTIAL PRICE INCREASES IN SECOND-HAND HOUSING

According to the INE report, during the first term of this year new construction housing increased in price above 10%. This data may not strike us because, as we have already said, new housing is a scarce commodity in large cities and this has had an impact on its price increase. However, what strongly attracts our attention is the increase in second-hand housing prices. It is estimated that second-hand housing prices have grown 8,2% which is rather a considerable rise. The INE sets a Housing Price Index and takes as a basis the prices of 2015 and when we compare them with that year we see a growth of 39%. In 2015, the INE set an indicator of 100 points to measure housing prices in those days. Nonetheless, in 2021 the indicator registered 139 points. As we can see, there has been a very sharp increase in only seven years. At present, prices could be on the same level with those of 2009, although they still have not reached those of 2007 when the boom of the real estate bubble took place. In those days, the price indicator was set in 152 points (13 points above the year 2021). The difference with regard to that year is clearly shown in second-hand housing. In 2021, the points indicator for this type of property was registered in 136, whereas in 2007 it had reached 169 points.

A GENERAL RISE

The price increase that was registered in the first term of this year has taken place throughout the country. However, there are six communities that stand out above the rest, and these are the Balearic Islands, Cantabria, the Canary Islands, Andalusia, Murcia and the Community of Valencia, as well as the cities of Ceuta and Melilla.In all these places the price increase exceeded the average of 8,5% that we have previously mentioned (the Balearic Islands draw our attention because they are at the head of them all with a rise of 12%). If we take a look at the data as a whole, we notice that it is the highest interannual growth since the times of the real estate bubble. According to some experts, this rise can stretch over some time, although not for many more months. Let us see what will eventually happen.

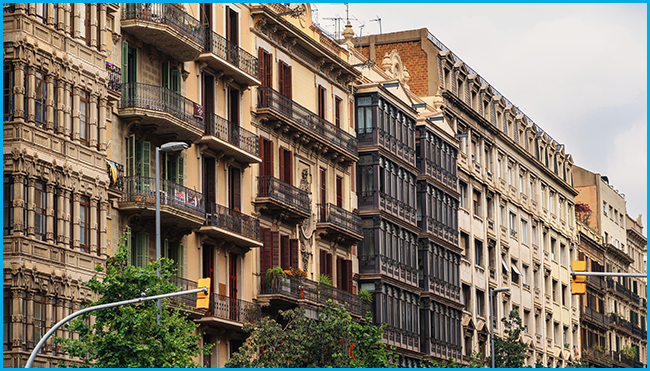

Picture 01: frimufilms

Picture 02: mario_luengo

Spanish

Spanish English

English